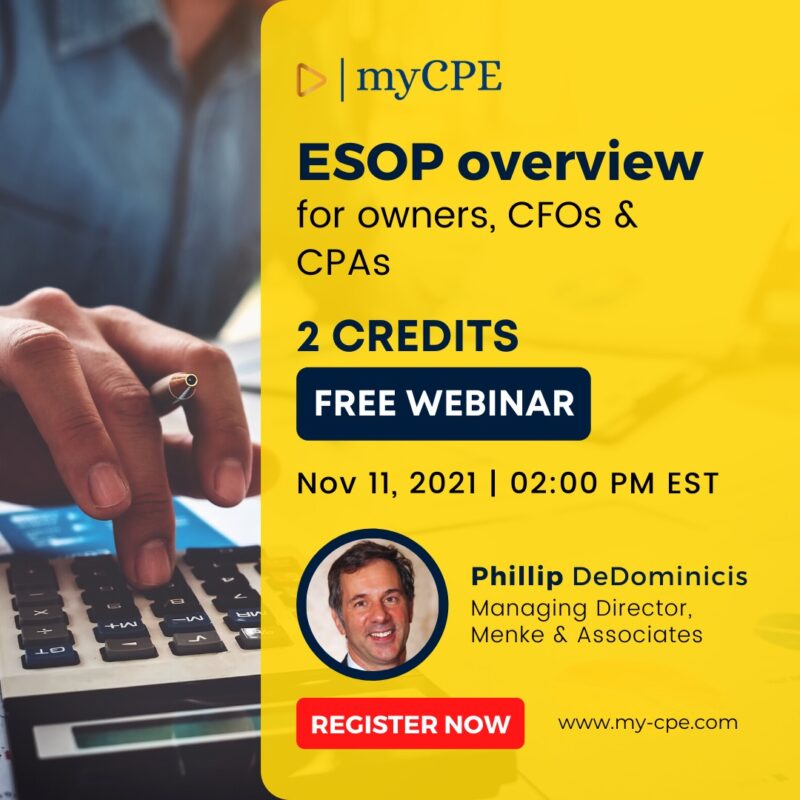

Nov 11, 02:00 PM EST — Phil DeDominicis will be presenting a free webinar, giving an overview on ESOPs for owners, CFOs & CPAs.

The CPE/CE webinar qualifies for 2 credits and provides a broad overview of ESOPs with the following topics:

Key topics discussed in this online CPE/CE course:

- Using ESOPs as a business succession tool

- How ESOPs are structured and financed

- Typically scenarios where they are used

- The tax differences and benefits between S corporation and C corporation ESOP owned companies

- Who runs and controls an ESOP owned business

- How ESOP shares are valued compared to other sale options

- How the employees benefit personally and become more productive

LEARNING OBJECTIVES

- To identify when ESOPs may be useful.

- To recognize basic facts about ESOPs and the benefits they provide owners & employees.

- To differentiate between C corporation strategies and S corporation strategies.

- To recognize how ESOPs valuations are derived.

- To identify the pros and cons of seller financing versus bank financing.

RECOMMENDED FOR

- This IRS-Approved CE course is recommended for EAs, AFSPs, and Other Tax Professionals advising about tax differences and benefits for ESOP owned companies.

- This will be a very informative CPE webinar for CPAs, Accountants, Finance Professionals, and Other Accounting Professionals who want to enhance their basket of services and grow their organization.

- This online CPE course is also recommended for CMAs, CVAs, ABVs, CFAs, CFOs, CEOs.

- This SHRM and HRCI Approved PDC course is good for HR Professionals engaged in managing ESOP-related activities in their organization.