John D. Menke, Founder and President

IRS qualified stock bonus plans and profit-sharing plans have existed in this country since they were first authorized by the Revenue Act of 1921. However, during the ensuing years very few stock bonus plans existed, and most of them were used by publicly traded companies as an employee incentive plan. Instead, most public-traded companies offered defined benefit plans, while most privately held firms offered profit sharing plans. All of these plans permitted the plan sponsor to make tax-deductible contributions to the plan, and none of them permitted the plan to purchase company stock from a company shareholder or to borrow money for the purchase of this stock.

In 1956, San Francisco attorney Louis O. Kelso used an IRS qualified profit-sharing plan to create the first example of a qualified retirement plan being used to borrow money for the purpose of acquiring stock ownership from company shareholders. This transaction, however, was only permitted pursuant to an obscure provision of the tax code which permitted case-by-case exceptions to what would otherwise be prohibited transactions. In effect, this was the first example of an IRS qualified plan being used as a tool for business succession.

From 1956 to 1968, when I joined the Kelso law firm as a young tax attorney, Kelso had succeeded in doing only a half-dozen or so of these plans, which were then called “Kelso Plans”. From 1968 to 1973, however, the Kelso firm was able to set up about fifty of these plans, mostly in privately held companies. This increase in activity was due to an IRS Revenue Ruling which made it possible to have these plans approved by Regional IRS offices rather than by the National Office of the IRS.

Then in September of 1973, the U.S. Senate passed its version of the Employee Retirement Income Security Act (“ERISA”) and sent it over to the House Ways and Means Committee. Under this initial version of ERISA, Kelso plans would have been entirely prohibited under the provisions defining prohibited transactions. As luck would have it, Mr. Kelso discovered this fact by accident during a conversation he was having with a Senator regarding another matter. A couple of days later, Mr. Kelso asked me to draft a legal brief to send to the Ways and Means Committee setting forth the arguments as to why Employee Stock Ownership Plans (“ESOPs”) should be exempted from the prohibited transaction sections of ERISA. I prepared this brief, and Mr. Kelso subsequently flew to Washington, DC to hand file it with the Ways and Means Committee by the deadline date.

Fortunately, a couple of weeks later a business colleague of Kelso’s was able to arrange a meeting between Louis Kelso and Senator Russell Long, who was then the Charman of the Senate Finance Committee. After hearing the philosophical and legal arguments as to why ESOPs would be good both for companies, for workers, and for the U.S. economy, Senator Long became a strong advocate for ESOPs in the U.S. Congress, and he mandated that the prohibited transaction exemptions that I had proposed in my legal brief be included in the final version of ERISA. Subsequently, ERISA was passed by the House on February 28, 1974, and by the Senate on March 4, 1974, before being signed into law on Labor Day, September 2, 1974.

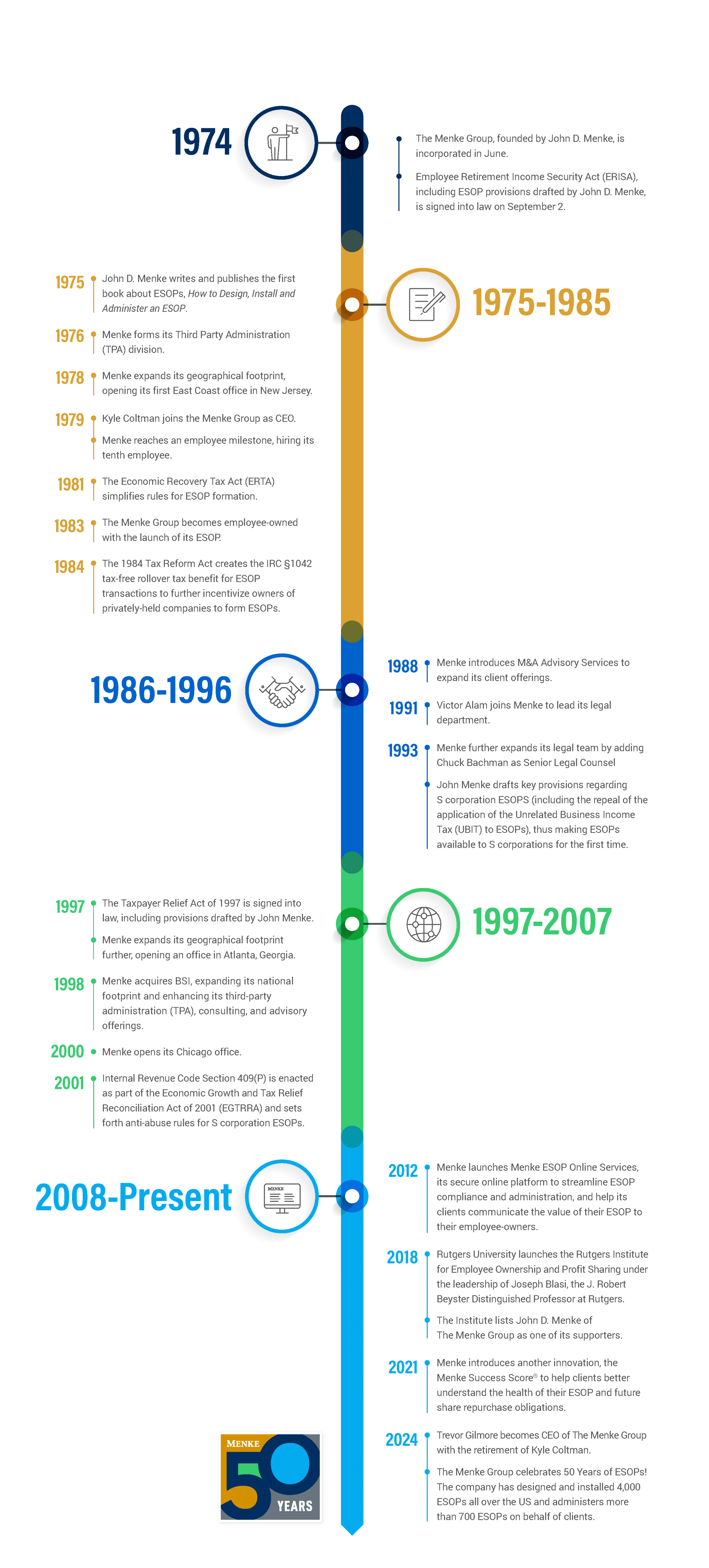

In the meantime, the Kelso law firm had created a separate investment banking firm, Bangert & Co., to advertise and promote the various uses of ESOPS. As this firm was gearing up to start promoting ESOPs once the ERISA act was signed into law, it became apparent to me that Bangert & Co. was going to focus its efforts on convincing large publicly held firms to adopt ESOPs. In my view, the biggest market for ESOPs was as a tool to create an internal market for founders and shareholders of privately held companies. Accordingly, I left the Kelso law firm in the Summer of 1974 and started the Menke firm as a financial consulting firm specializing in designing ESOPs for privately held firms.

For those readers who were not around in 1974, you should know that 1974 was one of the worst recession years this country had experienced since the Great Depression. The stock market had fallen by 27%. The unemployment rate was 7.2%. The inflation rate was 11%. Employee productivity was at a record minus 2.69% and there were over 6,000 labor union strikes, which was an all-time high.

Clearly, this was not the best time to start a new business, especially one that involved a new financial product that most people had never heard of. However, we were fortunate and from 1974 to 1984, we had a slow but steady growth in revenues and profits.

Most ESOPs we installed in those years started out with the ESOP acquiring a small minority interest and then gradually acquired more ownership year-by-year over the following years. In 1984, however, Congress passed the Internal Revenue Act of 1984, which included several pro-ESOP provisions, most notably the IRC §1042 tax-free rollover provision for ESOPs. Under this provision, if an ESOP acquired 30% or more of the outstanding stock of a regular C corporation, the seller could elect to pay no capital gains tax on that sale, provided that the seller purchased a like amount of qualified replacement property (U.S. stocks or bonds) within 12 months of the date of the sale.

The §1042 tax deferral created a huge incentive for owners to sell their shares to ESOPs since that would enable them to get liquidity without triggering a capital gains tax during their lifetime. As a result, there was a large increase in the number of ESOPs installed from 1984 through . In addition, since the ESOPs were required to purchase at least 30% at the outset, most ESOP transactions from 1984 onward were leveraged with bank loans, and most ESOP transactions began to take on the look and feel of leveraged buyout transaction.

In the Tax Reform Act of 1986, Congress reduced the maximum individual income tax rate from 50% to 28% and the maximum corporate tax rate from 50% to 35%. Since the maximum individual income tax rate was then substantially less than the corporate income tax rate, many privately held corporations over the next 10 years switched from C status to S status to save taxes. However, since S corporations were not permitted to adopt ESOPs, the market for ESOPs began to gradually decline after passage of the 1986 Act. Because our mission has always been to provide employee ownership to as many employees as possible, we needed to find a way to counteract this trend.

After thinking about this problem for several weeks, it occurred to me that there was a way to solve this problem that would enable S corporations to provide the same stock ownership benefits to their employees as C corporations provided, without the loss of tax revenues that would occur as a result of an S corporation being a tax pass-through entity. The answer was simply to provide that S corporations would pay a tax on their pass-through earnings (just like regular corporations pay taxes on their earnings at the corporate level) by having the ESOP pay taxes on its unrelated business income (“UBI”). In fact, there was already a long history of qualified plans of C corporations having to pay a UBI tax on unrelated business income. Accordingly, I drafted proposed legislation to implement this solution and sent it to the ESOP Association of America for their consideration.

Long story short, the ESOP Association subsequently approved this solution and sent it on to several of their supporters in Congress, who signed on as co-sponsors of this legislative proposal. A few years later, the proposal gained enough co-sponsors to secure passage by both houses of Congress, but with one pleasant surprise. In the final version of the Act, Congress decided to delete the provision for the UBI tax, based upon the argument that S corporations are designed to eliminate the double taxation of income. Since employee participants will pay ordinary income tax when they receive their ESOP distributions upon retirement or termination of employment, it would be inconsistent to also impose a UBI tax on the trust’s share of income that is attributed to it as a S corporation shareholder.

Thus, starting in 1997 S corporations were permitted to adopt ESOPs, and a whole new chapter of ESOP activity began. Today, for example, there are far more ESOPs maintained by S corporations than are maintained by C corporations. Further, the structuring and implementation of ESOPs has become substantially more complicated as corporations who are considering an ESOP must now weigh the merits of continuing to operate as a C corporation or as an S corporation versus switching to C or S status to obtain maximum tax benefits.

From 2000 to 2020 our firm continued to grow its revenues. When COVID hit the country at the beginning of 2020, we thought our revenues and profits would probably decline substantially for several years to come. Instead, 2020 through 2023 turned out to be the four best years we ever had for revenue growth and transaction activity. In hindsight, the onset of COVID coincided with a “silver tsunami” of business owners who decided it was time to sell their businesses and retire. As a result, there was a substantial increase in the number of completed ESOP transactions over the last four years. Last year, for example, we advised on 32 ESOP transactions, and the total value of these transactions was $1.1 billion.

Looking back over the past 50 years, it is very gratifying to know that our firm has continued to grow and persevere despite various changes that have occurred in the US economy during that time span. Obviously, we could never have managed this result without the tremendous dedication and productivity of our own employee owners, who now own over 90% of our company. Even today, due to their efforts, our firm installs approximately 20% of all new ESOPs adopted each year, despite the prevalence of more competitors than ever before.

Looking back over the past 50 years, it is also very gratifying to see the growth and evolution of the ESOP industry as a whole. As mentioned earlier, when I first started with the Kelso firm there were only a half-dozen or so ESOPs in place, and there was no statutory basis for ESOPs in the tax code. Today, there are over 6,533 ESOPs in the country, holding $2.1 trillion in assets. These ESOPs cover 14.7 million employees, which means there are now twice as many employee owners as there are employees who are members of unions in the private sector of the economy. Even more striking is the fact that in 2021 alone (which is the latest data available), the dollar value of benefits paid out by ESOPs was approximately $175 billion. Based on these numbers, one can estimate that the value of benefits paid out by ESOPs over the last 50 years is at least $5 trillion.

Despite this success, however, there are still millions of employees in this country who do not enjoy the benefits of being employee owners. Accordingly, we must redouble our efforts over the next 50 years to expand the knowledge and acceptance of ESOPs so that a much greater percentage of US companies and their employees can enjoy the benefits of being employee owners.

John D. Menke